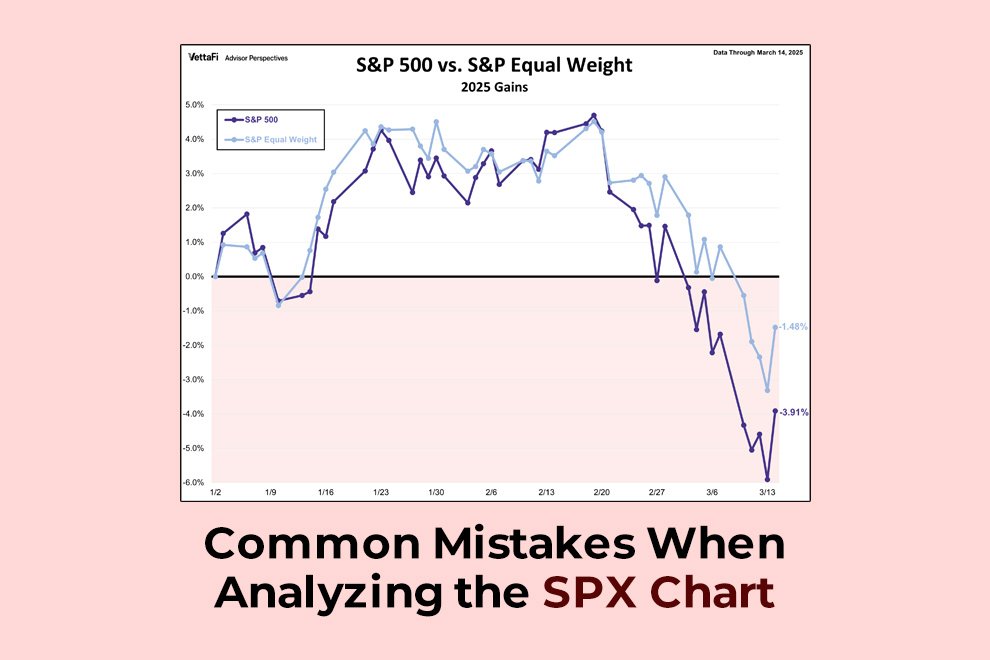

The world of stock market analysis can be both exhilarating and threatening for investors at any skill level. Among the methods used for following market performance, few are as important as the Standard & Poor’s 500 Index, or the SPX. Most investors frequently check the SPX chart when making significant financial choices, but there are some prevalent errors that lead to suboptimal analysis and, eventually, doubtful investment decisions. Knowing these missteps can prevent novice and expert traders alike from making better judgments when interpreting data from the markets.

Overreliance on Short-Term Volatility

One of the most common blunders investors make when interpreting the SPX chart is putting a lot of significance on short-term volatility. Market fluctuations over the course of a single trading day tend to represent short-term responses to news or events and not underlying changes in the direction of the market. They can cause short-term swings that lead to emotional behaviors and impulsive decisions. Rather than acting upon what you observe on the SPX real-time chart, take such swings into perspective in the context of overall market trends and economic fundamentals to form a well-rounded point of view.

Overlooking the Larger Picture

A second main mistake is not taking into consideration the broader economic environment in chart pattern analysis. Financial markets don’t operate independently – they react to an intricate network of influences ranging from monetary policy to economic growth measures, geopolitical developments, and industry performance. By looking at today’s SPX live chart, keep in mind that what you see is the result of many forces having converged. Without keeping these overall considerations in mind, chart analysis becomes much less informative and even misleading for your investment plan.

Relying Too Heavily on Technical Indicators

Although technical indicators are informative, relying too heavily on them without recognizing their limitations can be a disadvantage. Moving averages, Relative Strength Index (RSI), and Bollinger Bands are all good tools, but they’re best used in conjunction with other forms of analysis. These indicators rely on historical data and mathematical formulas that fail to consider abrupt market changes or unexpected occurrences. A balanced method incorporates technical analysis and fundamental research for a deeper understanding of the market.

Misinterpreting Chart Patterns

Chart patterns can provide hints regarding likely future price movements, but false identification of patterns is a common trap. Many investors, for example, incorrectly identify normal market noise as double bottoms or head-and-shoulders patterns. This incorrect identification usually results from a need to see confirmation of preconceived notions regarding the direction of the market. Successful pattern identification calls for patience, practice, and an objective mindset that is willing to consider more than one probable outcome instead of trying to fit patterns into preconceived concepts.

Neglecting Time Frames

Various time periods have different stories to tell, and studying only one side can result in incomplete conclusions. Day traders may study only hourly charts and overlook weekly or monthly trends that may indicate an upcoming reversal. Long-term investors, on the other hand, sometimes overlook important short-term opportunities by studying only long time frames. A complete analysis takes into account various viewpoints of time to determine both short-term trading opportunities and long-term directional trends in the market.

Forgetting Volume

Price action conveys only half the information. Volume – the quantity of shares traded in a given time frame – gives vital context to price action. High-volume price action tends to mark more important and lasting trends than those found on low-volume days. Most analysts overlook this all-important confirmation tool while concentrating solely on price patterns. Having volume analysis as part of your chart review serves to confirm the robustness and viability of noted trends.

Falling into Confirmation Bias

People have an automatic tendency to acquire information that supports established beliefs and dismiss contradictory evidence. In the interpretation of market charts, this confirmation bias may cause investors to decode data in a manner consistent with their current holdings or expectations. A bullish investor, for instance, may overlook explicit warning signals of a bear market because they contradict his optimism. Becoming conscious of this proclivity and consciously looking for disconfirming evidence is a step toward more objective and accurate chart interpretation.

Missing Support and Resistance Levels

It takes experience and skill to identify the right support and resistance levels. Most analysts plot these lines too neatly or on minor price levels, which creates false signals. Instead of conceptualizing support and resistance as precise price levels, think of them as zones where buying or selling pressure has previously increased. This zone-based concept recognizes the inherent uncertainty of markets and permits more realistic and flexible analysis of possible price movements.

Overlooking Market Sentiment

Technical analysis doesn’t reflect market sentiment—the general attitude of investors regarding a specific security or market. Fear, greed, and other feelings heavily impact trading and thus market price action. Certain investors mistakenly view chart analysis as strictly mathematical and do not account for the psychological forces behind market action. The addition of sentiment indicators to standard chart analysis offers rich information regarding probable market direction and the continuation of existing trends.

Expecting Perfect Accuracy

Arguably, the most basic error is the expectation of perfectly precise forecasting by chart analysis. Markets are driven by hundreds of factors, many of which are uncontrollable. Even the most advanced forms of analysis contain constraints and cannot possibly assure a certain result. Instead of pursuing certainty, effective analysts apply charts to find probability and control risk based on the likely event. This probabilistic strategy recognizes the unavoidable uncertainty in markets while enabling rational decision-making on the basis of the most probable events.

Conclusion

Reading the SPX chart today successfully involves a combination of technical expertise and an understanding of common pitfalls in analysis. By avoiding these errors, investors can achieve a better sense of market movement and make more informed investment choices. Keep in mind that chart analysis is most effective as part of an integrated investment plan incorporating fundamental research, risk management guidelines, and definite investment goals. No method promises success in the volatile arena of financial markets, but having knowledge of these most frequent mistakes will allow you to gain better insights from market data and improve your investment returns.

Also Read: Demonetization Impact on the Stock Market and Stock Investors