Accounting offers a significant professional advantage in today’s environment due to the numerous opportunities it presents. An accountant oversees a company’s finances. They actively audit, record financial transactions, generate financial statements, evaluate financial data, and provide management with budgetary advice, actively monitoring spending. If you aspire to work in accounting, pursuing a master’s degree is imperative. This actively enables you to secure a better job and a higher wage. In this blog, we will actively explore the advantages of a Master’s in Accountancy.

1. What is a Masters of Accountancy?

Masters of Accountancy, also known as MAcc or MSc in accounting, represents a graduate program designed to furnish advanced knowledge and training in the field of accounting. Students who have completed an undergraduate degree or a related program pursue a Master’s in the same field. Completing a master’s in accounting usually takes up to two years.

The program primarily aims to enhance comprehension of accounting principles, practices, regulations, and methodologies. Its purpose is to equip students for careers in various accounting-related roles, such as public accounting, corporate accounting, auditing, taxation, financial analysis, consulting, and more.

Normally, you need a bachelor’s degree in accounting to progress to a postgraduate degree. However, certain degrees can be pursued with an undergraduate degree in a related field. Moreover, some programs may enforce a minimum GPA requirement and might consider standardized test scores like the GMAT or GRE.

2. Requirements For A Masters of Accountancy

- Bachelor in Accounting or a Related Field: Most MAcc programs require applicants to have a bachelor’s degree in accounting or a related field, such as finance or business administration.

- Extra Courses: It is preferred if an individual, along with his undergrad degree, also takes extracurricular courses in subjects such as statistics, calculus, and economics.

- Application Form: Applicants must submit an application form to the MAcc program they are interested in.

- Transcripts: Applicants must submit official transcripts from all colleges and universities they have attended.

- Letters of Recommendation: Applicants must submit two or three letters of recommendation from former professors or employers who can prove their academic ability.

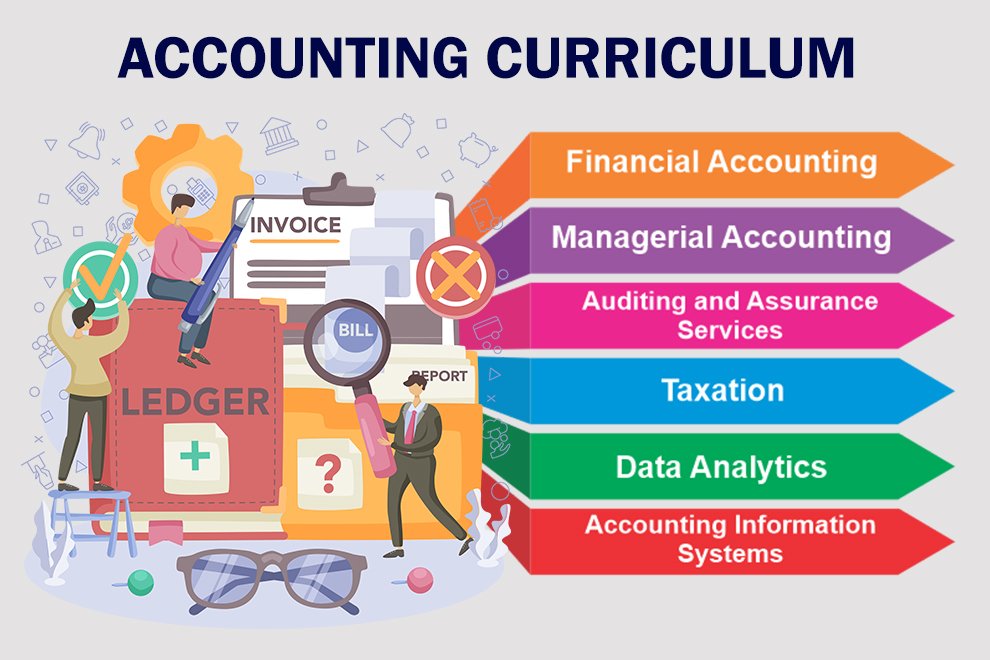

3. Curriculum

For a master of accountancy, the curriculum may differ based on the university and country. The courses are a combination of accounting subjects as well as business administration subjects. Specializations are also included in the course structure. Some sample subjects are as follows:

- Financial accounting: This course covers the fundamentals of financial accounting, such as the accounting cycle, financial statements, and auditing.

- Managerial accounting explores cost management, budgeting, performance measurement, and decision-making for managers.

- Auditing and Assurance Services: Covers billing concepts, techniques, standards, and legal responsibilities.

- Taxation: This course focuses on individual taxation and corporate taxation. One studies how to plan taxes and their impact on business decisions.

- Data Analytics: Teaches data analysis techniques, including using tools like Excel, databases, and specialized software.

- Accounting Information Systems, Professional Ethics, and Responsibilities Advanced Business Law for Accountants, Strategic Management, and Financial Statement Analysis are some of the other courses for a degree in Masters of Accountancy.

Elective courses are

- Forensic accounting: This subject covers accounting tactics to investigate fraud or financial crimes.

- International accounting: This subject covers the rules and regulations of accounting that are used for international businesses.

- Corporate finance: This subject covers the financial aspects of running a business, such as raising capital, investing, and managing risk.

- Internal audits and controls: The subject covers the internal auditing process, risk assessment, and control systems.

- Tax Strategy and Planning: Advanced knowledge of tax strategies for businesses and individuals.

4. Professional Certificates You Recieve

After a master’s in accounting, you receive professional certificates that enhance your career growth. They are as follows:

- Certified Public Accountant: CPA is one of the most recognized certifications. Opens doors to a wide range of accounting and financial roles, including auditing, taxation, and consulting. To earn the CPA designation, you must pass a series of exams and meet certain work experience requirements.

- Certified Management Accountant: CMA focuses on management accounting and financial management skills. It is designed for accountants who work in managerial accounting roles. Requires passing the CMA exam and meeting educational and experience criteria.

- Chartered Accountant: CA is one of the most common professions in accounting. It requires great skill. It is a professional designation that is awarded by the Chartered Professional Accountants. To earn the CA designation, you must pass a series of exams and meet certain work experience requirements.

- Certified Internal Auditor: The CIA is designed for accountants who work in internal auditing roles. It requires passing the CIA exam and fulfilling education and experience prerequisites. Enhances your skills in internal auditing, risk assessment, and control evaluation.

- Certified Fraud Examiner: It is designed for accountants who work in fraud examination roles. To earn the CFE designation, you must pass the CFE exam and meet certain experience requirements. It is valuable for forensic accounting and anti-fraud roles.

- Other certificates include the Chartered Global Management Accountant, Enrolled Agent, Chartered Financial Analyst, and Certified Financial Planner.

5. Career Opportunities

After you complete your Masters of Accountancy you have a variety of career opportunities where you can work. Some of them are:-

- Accounting Manager: The account manager is responsible for ensuring the timely and accurate delivery of financial statements and reporting. He or she leads the team of junior accountants to ensure that proper accounting methods are used. The average salary of an accounting manager ranges up to $94,641 per year.

- Tax Manager: A tax manager is responsible for overseeing and preparing tax documents. He or she has to strategize in developing tax strategies and policies that ensure that a business is complying with the local tax laws and regulations. The average salary for this post ranges up to $103875 per year.

- Compliance Risk Manager: These professionals are responsible for preserving a company’s integrity through policy development and enforcement. They must also address any sort of consent issue regarding the same. The Risk and Compliance Manager’s salary range is from $109,806 to $139,892.

- Corporate Controller: These professionals supervise all the accounting and financial functions of a company. They work closely with the CFO and other senior executives to ensure that the company’s financial statements are accurate and compliant with applicable laws and regulations. Their average salary is $110402 in 2023.

- Director of Accounting: These people mostly provide consulting services to the company and financial team. Overseeing the day-to-day operations of the accounting department, developing and implementing accounting policies and procedures, providing financial advice to senior management, etc. are some of their duties. Their average salary is $112063 in 2023.

- Forensic Accountant: Forensic accountants have two main duties: legal support and investigation. A forensic accountant is a specialized accountant who uses their knowledge of accounting, auditing, and investigative skills to investigate financial crimes. $73,712 is the average salary of a forensic accountant as of 2023.

- Director of Finance and Accounting: A director of finance and accounting (DFA) is a senior-level accounting professional who is responsible for overseeing the financial and accounting operations of a company. They typically report to the chief financial officer (CFO) and work closely with other members of the executive team. Their average salary ranges from $163,508 to $228,588.

- Chief Financial Officer (CFO): The CFO is responsible for the financial management of an organization. The CFO typically reports to the Chief Executive Officer (CEO) and is responsible for developing and implementing the organization’s financial strategy. The salary of a CFO can range from $326,231 to $552,440.

6. Future Trends of Accountancy

As you finish your Masters of Accountancy, these are some of the trends you might see in the future:

Technology and Automation: In the future, repetitive tasks can be avoided through technology. Currently, the technology is not so evolved to understand the tasks with the utmost accuracy, but in the future, this will be possible.

- Accounting Software: Companies plan to implement cloud-based accounting solutions in the near future. It can integrate your accounting software and your financial data with other important areas of your business.

- Data Analytics: Data analytics is the process of using data to extract insights and make predictions. This is becoming increasingly important in accounting as businesses generate more and more data. Accountants who are skilled in data analytics will be in high demand.

- Digital Transformation: Today, it has been seen that all businesses have become digital, as it is very convenient. Accounting and finance teams have adapted to account for new revenue from subscription models, new channels, new physical and digital product offerings, and more.

- Data Security: Data breaches have become an issue for every business. Hence, accountants are also given training to secure data. This includes recognizing harmful emails and scams that could lead to data breaches and leaks of the company’s financial data.

A master’s degree in accounting could offer you the greatest advantages if you want to work in the accounting department. We have outlined the educational requirements, curriculum, professional certifications, job opportunities, and future trends in accounting. Obtaining a master’s degree enhances the value of your education and expands your horizons by providing access to numerous job opportunities. We trust that you have gained valuable insights from this blog. Keep reading The Education Magazine for more content of a similar nature.

ALSO READ: 10 Soft Skills for Students for Personal and Professional Growth (First one is very important!)