In today’s fast-paced world, keeping track of monthly bills can feel like an overwhelming task. Whether it’s utility bills, credit card payments, or subscription services, missing deadlines is not just stressful but can also lead to late fees or service disruptions. Enter the payment app, a digital solution that promises to streamline this process. In this article, we’ll explore how to effectively automate your bill payment using a payment app, ensuring not just convenience but also peace of mind.

Understanding the Basics of Payment Apps

Before diving into automation, it’s essential to understand what a payment app is. Essentially, a payment app is an application on your smartphone that allows you to make transactions electronically. Popular payment apps include Paytm, Google Pay, and PhonePe, each offering a plethora of features that aim to simplify financial transactions.

Advantages of Using Payment Apps

Payment apps provide several advantages that make them an attractive option for managing finances. Here are a few:

- Convenience:

- With a payment app, you can settle your bills anytime, anywhere, at the tap of a finger.

- Security:

- These apps use advanced encryption technologies to ensure your financial information is secure.

- Efficiency:

- Payment apps save time, eliminating the need to physically visit a payment centre or log into multiple portals.

Steps to Automate Your Bill Payments Using a Payment App

Now that we understand the basics, let’s delve into the steps required to automate your bill payments using a payment app.

Step 1: Choose the Right Payment App

The first step in automating your bill payment is selecting a payment app that suits your needs. When choosing, consider factors such as ease of use, features offered, and user reviews. Some apps cater more to utility bills, while others may offer broader services including investment options.

Step 2: Set Up Your Account

Once you’ve selected an app, the next step is setting up your account. This typically involves downloading the app, entering your personal details, and linking your bank account or card. Ensure your app has robust security measures such as two-factor authentication.

Step 3: Identify Bills to Automate

Decide which bills you want to automate. Common candidates include electricity, internet, mobile phone, and credit card bills. Consider starting small and gradually adding more as you become comfortable with the process.

Step 4: Add Billers to the App

Most payment apps allow you to add billers by selecting them from a list or manually entering their details. Follow the prompts to add each biller. Ensure the information is accurate to avoid any issues later.

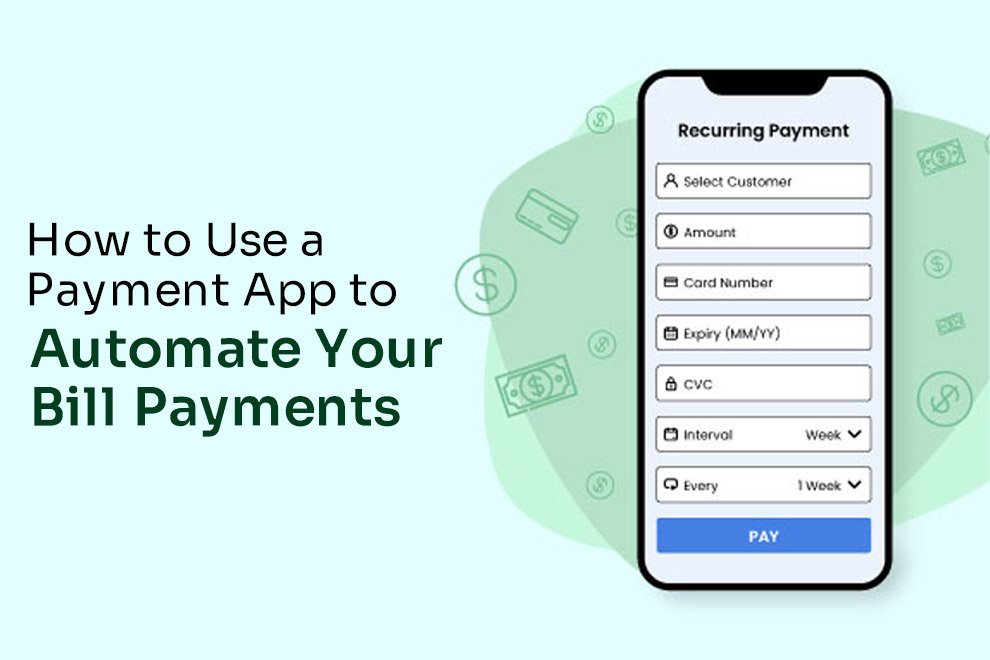

Step 5: Enable Auto-Payment

After adding billers, the next step is to set up auto-payment. Navigate to the biller settings, choose the auto-pay option and select your preferred payment method. You might need to specify the payment date and amount, especially if the amount varies.

Step 6: Monitor and Manage Payments

Lastly, while automation reduces manual effort, it’s crucial to periodically review your transactions. Monitoring ensures everything is functioning correctly and alerts you to any potential issues like insufficient funds.

Ensuring a Smooth Automation Experience

Automating bill payments is relatively straightforward, but keeping a few things in mind can enhance your experience.

Maintain a Consistent Balance

Ensure your linked account has a sufficient balance to cover the automated payments. Set reminders, or better yet, automate your salary deposits into this account.

Regularly Update the App

Developers frequently update apps to include new features or security patches. Keeping your app updated ensures you benefit from these enhancements.

Stay Informed About Offers

Payment apps often roll out offers or cashback deals. While the focus should remain on automation, staying informed can provide additional financial benefits.

Data Security Awareness

Ensure your payment app remains secure by keeping your phone’s operating system up-to-date. Regularly change your passwords and avoid using public Wi-Fi for transactions.

Conclusion: Embrace the Future of Finance

Automating bill payment through a payment app not only simplifies life but brings a modern approach to managing finances. This small step towards automation reflects a broader digital revolution enabling us to save time and reduce financial stress. Don’t get left behind in this digital age; embrace the technology, and enjoy the leisure that reliable, hassle-free bill payments bring.

By following the steps outlined above, you can ensure your bill payments are always on time. In the long run, leveraging automation in this manner allows you to focus on what truly matters—whether that’s pursuing personal passions, spending time with family, or simply enjoying the freedom from financial worry. So, what are you waiting for? Dive into the world of automated bill payments today and experience the transformative power of digital finance.

Also Read: Why Zupee App Download is the Hottest Trend in Online Gaming?